Algoflex is a systematic quantitative, multi-strategy crypto trading platform engineered to deliver consistent, risk-adjusted returns. Our institutional-grade engine runs 24/7 across dozens of liquid assets, executing trades directly in your exchange account.

AlgoFlex blends momentum, mean-reversion, and hedged strategies with real-time volatility targeting, delivering hands-free alpha.

Dozens of algorithmic strategies run in parallel (trend, breakout, mean-reversion, etc.), with our AI constantly scoring and reallocating capital to the top performers.

Trades long/short across the top 50 liquid crypto assets (perpetuals) on major exchanges, ensuring deep liquidity and opportunity in all market regimes.

Ultra-low latency infrastructure executes orders around the clock. The system auto-adjusts positions based on market volatility and structure, so you capitalize on moves in any timezone without lifting a finger.

Net exposure limits, dynamic position sizing, capital-utilization caps, automated short hedges and drawdown throttles protect your capital.

Retain full custody of funds at all times, trades are executed via encrypted trade only API Keys in your Binance/Bybit Account.

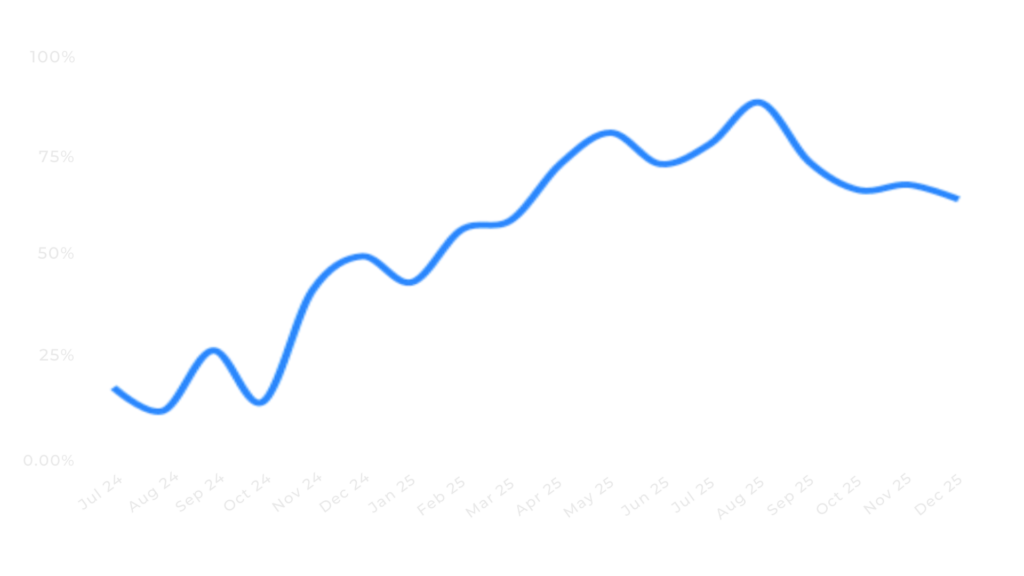

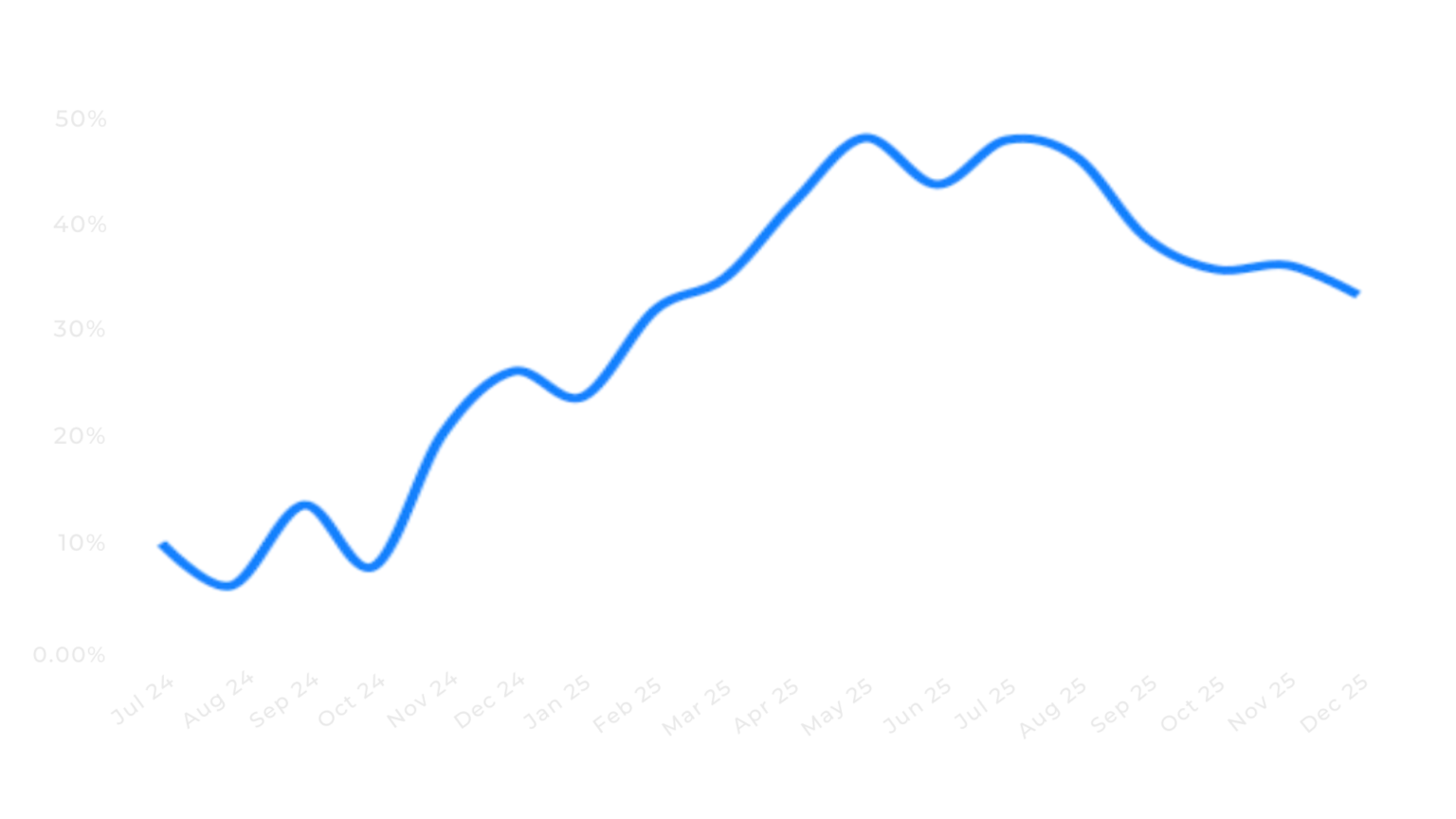

Backed by years of research, out-of-sample testing, and live trading, AlgoFlex consistently delivers high risk-adjusted returns with Sharpe ratios between 3–4 and controlled drawdowns—even during extreme volatility and market dislocations.

AlgoFlex uses systematic trading models combining momentum, mean-reversion, and hedged strategies to deliver returns across market regimes with disciplined risk controls and automated execution.

We trade the top 50 liquid crypto assets (perpetual futures) daily, filtered by volume and liquidity.

AlgoFlex is non-custodial, client retain full control of funds. We use trade-only API keys, net exposure limits, dynamic position sizing, capital utilization caps, hedges, and drawdown throttles.

We apply modest leverage with position sizes typically in the 1–3% range, adjusted dynamically for market volatility.

Clients receive real-time dashboards, NAV tracking, monthly performance reports, and full exchange-verified trade logs.

1. Connect & Discover: Start by reaching out to the AlgoFlex team for a brief consultation. You’ll get educated about our models, their risk profiles, and historical behavior so you can make an informed decision aligned with your investment goals and risk appetite.

2. Open & Connect: Create or use an existing account on a leading crypto exchange (we recommend Binance or Bybit for liquidity and security). Generate trade-only API keys and link them securely to AlgoFlex. Withdrawals are disabled by design, ensuring full custody remains with you.

3. Select Strategy: Choose the model that best suits your profile.

(a) High Sharpe High Vol (USD/ETH/BTC) – short-term breakout and mean-reversion strategies targeting higher growth and higher activity.

(b) High Sharpe Low Vol (USD/ETH/BTC) – same core models, adjusted for steadier returns and smaller drawdowns.

4. Go Live: Once your API is connected and your strategy is set, AlgoFlex’s AI engine takes over. It dynamically selects the optimal models each day from our pool of 50+ strategies, auto-adjusting positions based on volatility and market structure.

5. Monitor & Report: You retain complete visibility. Real-time dashboards, NAV updates, and performance analytics help you track portfolio performance and understand its behavior across market cycles.